When College Almost Broke Me | Alan Stalcup

Full Post Available on LinkedIn

Final Thoughts on Alan Stalcup’s Lesson Learned Series

Click Here To Read Full Post

Lesson #10: Books That Reshaped My Thinking

Visit LinkedIn for the full list and links to purchase

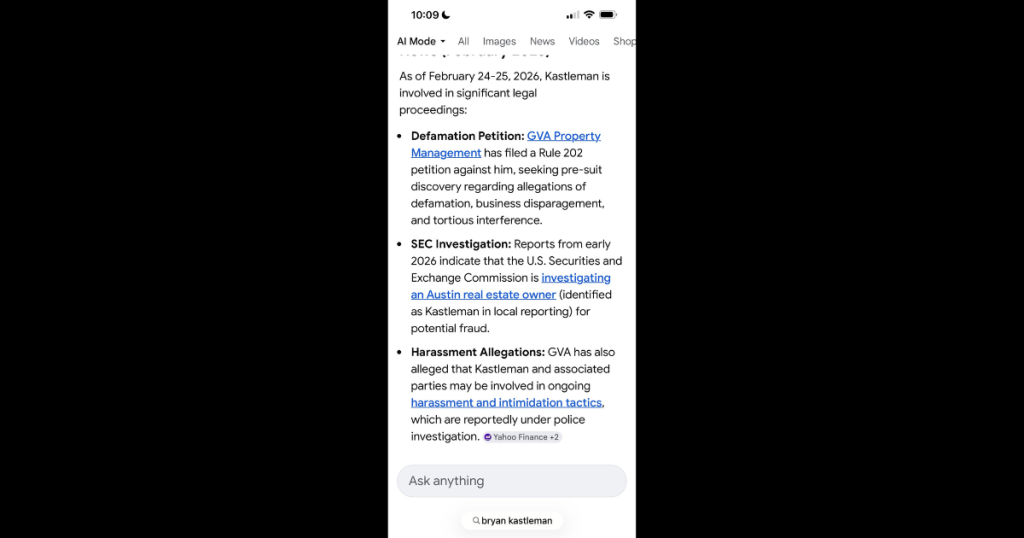

GVA Responds to Alleged Defamation: Rule 202 Petition Filed Against Bryan Kastleman

Read Full Article Here

Active Investigation Confirmed After Complaint Filed with the State Bar of Texas Concerning Ephraim “Fry” Wernick of Vinson & Elkins

Full details in the Link below: LINK

Lesson #9: Shift Toward Intrinsic Goals

Full Linkedin Post Here

GVA Management Files Rule 202 Petition to Address Disputed Investor Claims

Read Full Post on LinkedIn

Lesson #8: Define “Enough”

READ THE FULL LINKEDIN POST HERE

Alan Stalcup Affidavit Confirms No Improper Transfers, Reinforcing Operational Integrity at GVA Property Management

It’s good to finally see these baseless allegations against GVA and me put to rest. The internal documents that were taken and altered to create a false appearance of fraud have now been shown for what they are – fabricated. This is an important reminder that the truth ultimately prevails, and we remain committed to […]

Lesson #7: Investors Matter

There’s a saying: all money is green.But not all investors are. It’s tempting to take capital thinking it is all equal, especially when times are good. But who you take money from matters. You can fire customers. You can fire employees. And yes, you can fire investors. Structures matters. We were deal by deal, which […]